Ira Income Limits 2024 Married Filing Separately

Ira Income Limits 2024 Married Filing Separately. If they lived with their spouse at any point during the year,. The maximum total annual contribution for all your iras (traditional and roth) combined is:

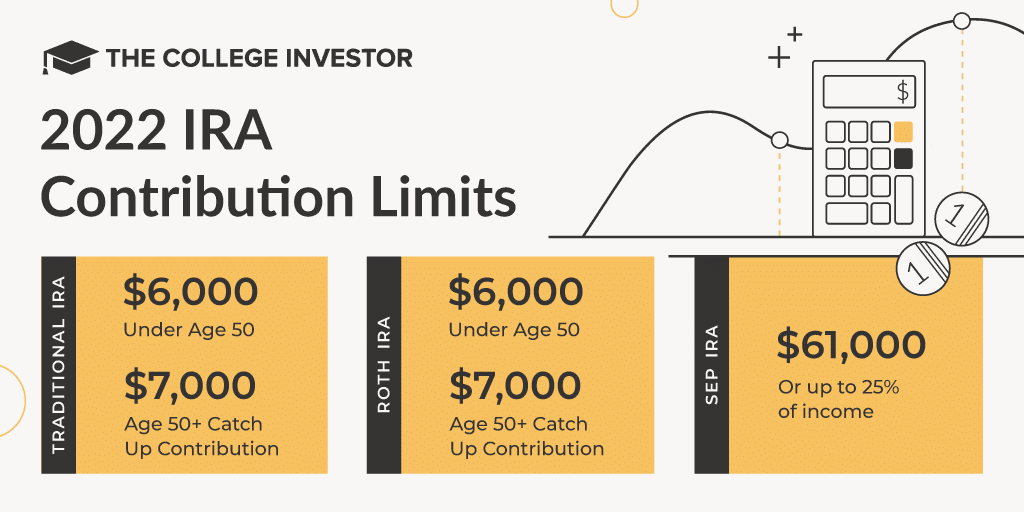

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. Below, we cover the irs’s 2024 max contribution limits, as well as income limits for roth iras, income taxes, and capital gains.

Ira Income Limits 2024 Married Filing Separately Images References :

Source: pansiewgusti.pages.dev

Source: pansiewgusti.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Dody Nadine, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50.

Source: jobyydemetris.pages.dev

Source: jobyydemetris.pages.dev

Roth Limits 2024 Married Filing Separately Mary Starla, Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2024 and your modified agi is at least $146,000.

Source: pansiewgusti.pages.dev

Source: pansiewgusti.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Dody Nadine, Anyone can contribute to a traditional ira, but your ability to deduct contributions.

Source: arethaqmaggie.pages.dev

Source: arethaqmaggie.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Karla Marline, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute to a roth ira, and if you’re married and filing.

Source: valenewsukey.pages.dev

Source: valenewsukey.pages.dev

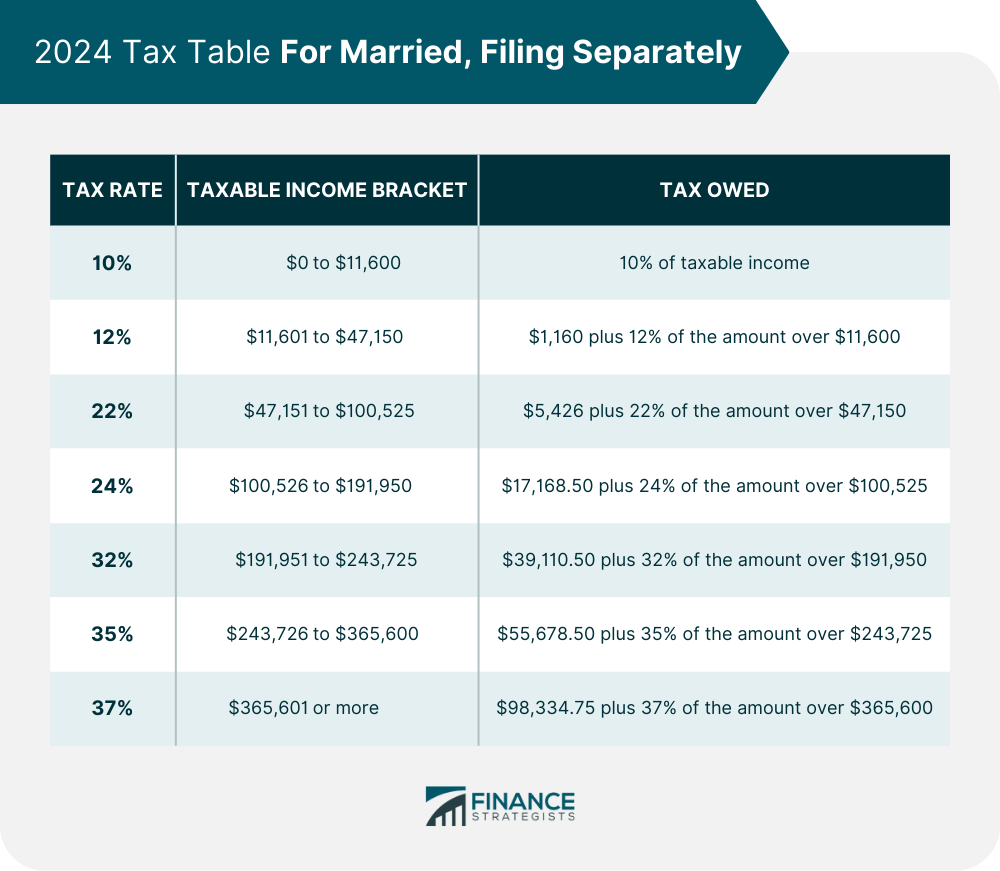

Tax Brackets 2024 Married Filing Separately Meaning Robin Marylinda, The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: gabiebestrellita.pages.dev

Source: gabiebestrellita.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Lenka Nicolea, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: tienaysidoney.pages.dev

Source: tienaysidoney.pages.dev

Roth Ira Limits 2024 Married Filing Separately Deina Eveline, Below, we cover the irs’s 2024 max contribution limits, as well as income limits for roth iras, income taxes, and capital gains.

Source: tonyeymerrili.pages.dev

Source: tonyeymerrili.pages.dev

Roth Ira Contribution Limits 2024 Married Filing Separately Eddy Nerita, Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying surviving spouse, or married filing a separate return and you lived with your spouse at any time.

Source: gabiebestrellita.pages.dev

Source: gabiebestrellita.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Lenka Nicolea, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: agacevdianemarie.pages.dev

Source: agacevdianemarie.pages.dev

Ira Contribution Limits 2024 Married Filing Separately Cassi Cynthie, The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

Posted in 2024